What is a home equity line of credit?

The home equity line of credit, also known as a HELOC, allows you to use the equity in your home as collateral to borrow against. A SkyOne HELOC gives you access to up to 80% of your primary residence’s home value, minus any first mortgage balance owed.

Here’s how the maximum line of credit limit is determined, with maximum amount possible at $200,000.

- $500,000 (home’s value) x 80% = $400,000 (home’s equity)

- $400,000 (home’s equity) – $300,000 (first mortgage) = $100,000 (your maximum line of credit limit)

When does a HELOC make sense?

A HELOC is especially beneficial when you’re looking to remodel your home, consolidate your debt, pay for large medical bills, or other big ticket items. The beauty of our HELOC is that you have the flexibility of using it as needed for your specific needs, but because it uses the equity in your home, the interest rate is much lower than credit cards or personal loans.

How does a HELOC work?

Think of the HELOC as a revolving credit card with a set limit that only requires a minimum monthly payment based on the balance you carry. SkyOne HELOCs have a seven-year draw period that allows you to customize the loan amount based on your needs. When the seven-year draw period ends, the remaining balance will be amortized for 15 years; this is also known as the repayment period. In essence, the HELOC can have a 22-year term.

With a SkyOne HELOC, your monthly payments are fully amortized so you are paying both principal and interest. Some lenders only require an interest payment each month, which lowers your monthly payment for the first few years, but can create a big financial burden when you have to pay the entire loan amount due at the end of the draw period. You can also pay off the balance at any time with no pre-payment penalty. And once your line of credit is set up, you don’t need to re-apply to borrow from the loan.

In addition to flexible repayment options, HELOCs usually have adjustable interest rates. SkyOne’s HELOC has a variable interest rate that can go up, down, or remain the same based on the prime rate. Check out SkyOne’s latest HELOC rate, at SkyOne.org/HELOC.

HELOC’s vs. home equity loans

In addition to HELOCs, SkyOne also offers a Home Equity Loan, which also uses the equity of your home to provide financing. Home Equity Loans are similar to HELOCs but provides the loan proceeds up front with fixed monthly payments.

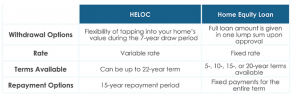

Below is a quick reference that compares HELOCs and Home Equity Loans.

To determine if a HELOC or a Home Equity Loan is right for you, check out our financial calculators.Based on your desired loan amount, you can see a sample payment amount.

Learn more about how our home equity loan products can help you.

Speak to a SkyOne Lending Specialist at 800.421.7111.

Courtesy of: Nerd Wallet, Dan Mostovoy, SkyOne Lending Manager, and Ed Salazar, SkyOne Loan Officer.